There is disagreement about the Federal Reserve’s influence on inflation. My view is that monetary policy is a critical (but incomplete) factor in determining the supply of money and therefore the nominal price of goods and services.

Under this framework, the rapid expansion of the Fed’s balance sheet and money supply during the pandemic is a primary culprit for today’s elevated inflation. Blunt criticism of the scale and persistence of monetary expansion from 2020-2021 is warranted, and this column has doled out plenty.

The Fed, for its part, seems to agree. Despite initially ignoring inflation, in late 2021, the Fed admitted that rising prices would not prove transitory, at least not on their own. Instead, a considerable tightening of policy was required.

But monetary policy, like a cruise ship, takes a long time to turn around. But to its credit, the Federal Reserve has engineered one of the fastest U-turns in history. Quantitative Easing has given way to Quantitative Tightening, while the Federal Funds Rate sits at its highest level since 2007. Dwelling on the Fed’s past largesse is neither useful in understanding the current monetary dynamic nor in predicting where we may be headed. The Fed has slammed on the brakes.

Unprecedented

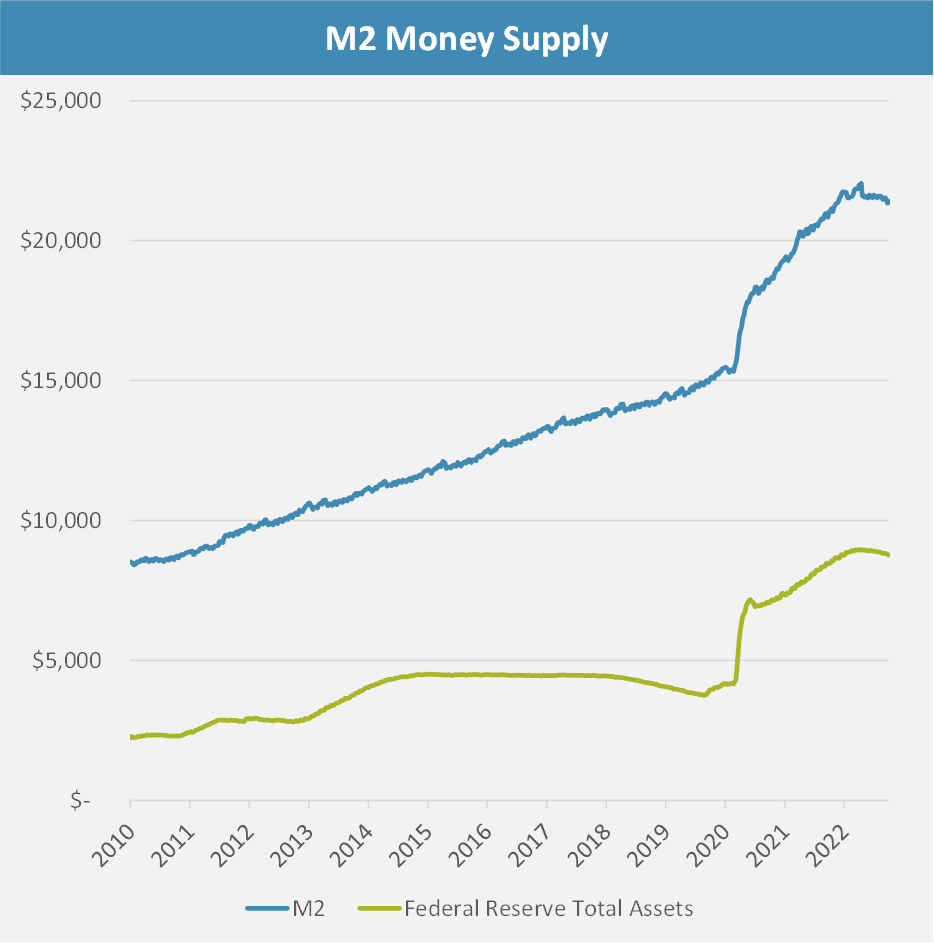

In an era of endless “unprecedented” events, here is one you should pay attention to. Broad money supply1, as measured by the Fed’s M2 reading, peaked in early 2022 along with the Fed’s balance sheet and has been outright shrinking for months.

This…doesn’t really ever happen. Throughout the monetary cycles of the modern era, there has always been more money in the present than there was a year prior. Well, at least until now.

While the year-over-year change in M2 is still marginally positive using the latest reporting from October, this figure will almost certainly dip negative in the coming months.

These charts demonstrate both the unprecedented scale of COVID monetary expansion and the rapid contraction over the past year. If monetary policy in 2020/2021 sought to paper over the real economic declines of the pandemic, today’s policy works in reverse. Shrinking money supply should put downward pressure on prices while curbing demand.

Recent data on inflation suggest this is well underway. Commodity prices - the beginning of the supply chain - peaked in June and are now in decline. Meanwhile, price increases for finished goods - prices between manufacturers and retailers - have begun to plateau. October readings for core consumer prices increased less than expected.

This is all welcome news when it comes to taming inflation, and of course, the stock market was over the moon on the soft October CPI readings. Excitement should be tempered.

First, the bond market has priced in a reversion to low inflation for much of the past two years and has been consistently wrong. The market expects the Fed Funds Rate to plateau in early 2023, followed by gradual cuts for the following two years. If inflation continues its downward path from here, it would merely mean that yields are appropriately priced today - it wouldn’t represent an “upside surprise”. Even if inflation comes back into the target range, it’s unlikely that the Fed will cut to zero absent a total economic collapse.

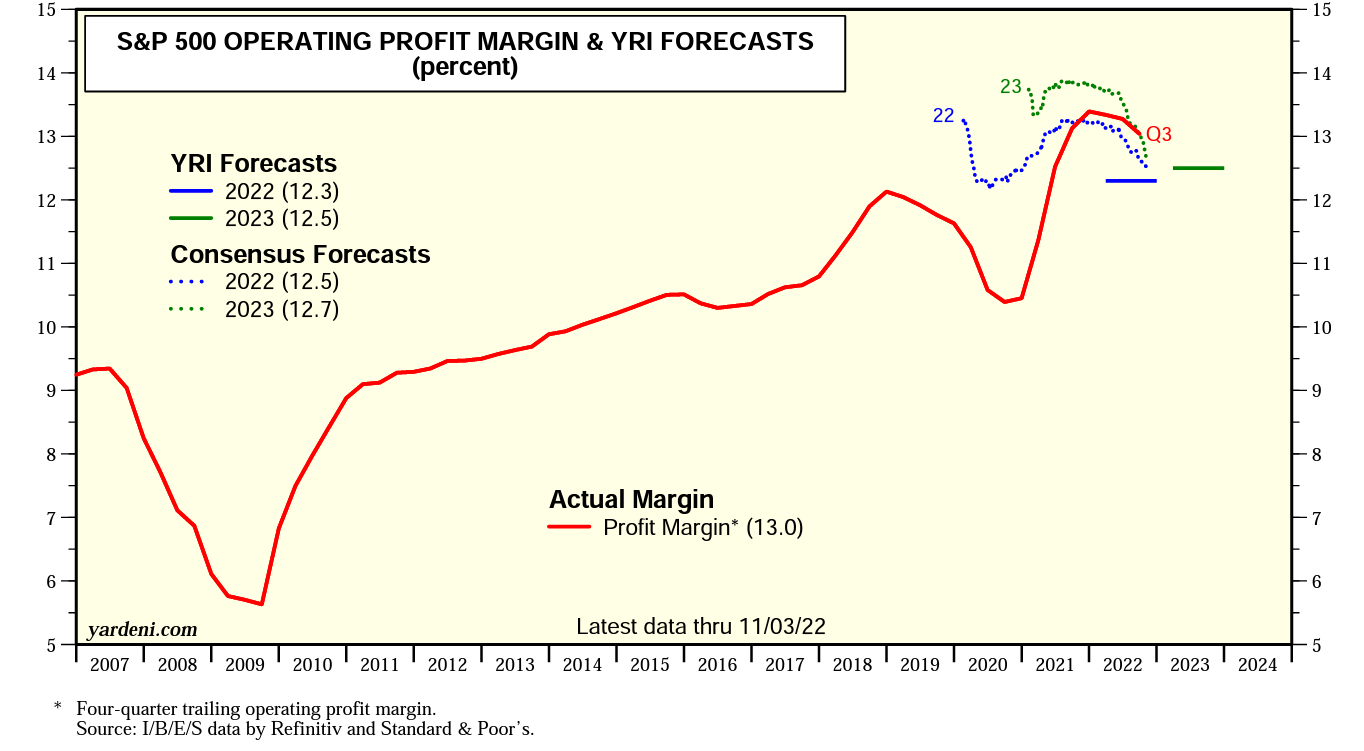

Second, over the past year consumer price inflation has driven substantial topline growth during a period of record operating margins, leading to robust corporate earnings. But today, margins are already rolling over. Softening demand means less ability to push prices to counteract shrinking margins.

Finally, even as rate hikes are the most common explanation for the declines in equities over the past year2, rate cuts are a worse sign for the market. The Fed tightens during strong economic conditions and eases when recessions are imminent. If the Fed is cutting, then any benefit of a lower discount rate is more than offset by declines in earnings.

The Fed cut rates from 6.5% to 1.75% from 2000 - 2002, while the S&P 500 declined over 50%. The Fed cut rates from 5.25% to 0% from 2007 - 2009, while the S&P 500 declined over 50%. The Fed slashed rates during the COVID pandemic, while the market fell 35% in a month. Investors should hope for strong economy - not cuts.

Yet, a healthy dose of humility is also needed. What happens when the Fed slams on the brakes? What are the true economic implications of shrinking money supply? I don’t know and neither do you. It hasn’t happened before.

On the one hand, we are just beginning to roll back the pandemic excesses. Money supply today still stands well above the trend of the prior decade. Households de-levered substantially and their balance sheets remain robust. Credit defaults of all varieties remain very low. The labor market remains short of supply, even as pockets of weakness have appeared in areas like tech and logistics. While the good purchases have declined from their pandemic peak, they remain above trend and services continue to rebound. Overall growth of real personal consumption expenditures (PCE) has yet to show any sign of wavering. Even real disposable income has picked up in recent months from a downtrend. We are not in a recession today.

On the other hand, when a central bank slams on the brakes you better buckle up. Real world implications of rate hikes take time to manifest, and we are likely just seeing the tip of the iceberg given the jumbo hikes since the summer. Housing seems set for a nasty correction, which has already begun to play out dramatically in the frothiest markets. Financial markets (and perceived wealth) have slumped as liquidity evaporates. There is no indication that the Fed intends to dial back its QT schedule, meaning more pain (and potential blowups) to come. Certainly the rest of the world seems to be in a more fragile economic state than the U.S. as well.

Beyond these immediate economic concerns, there are longer term questions. Will inflation return to its low baseline, or will it remain stubbornly persistent as it did in the 1970s? Is the ZIRP era truly over?

Without answers today, we must wait patiently for more data and avoid conclusions driven by dogma. Look through the windshield, not the rearview mirror.

Fishtail

Separate from the current direction of the economy, it’s worth considering the practical role of Fed in modern money creation. When discussing modern monetary policy - quantitative easing (QE) and tightening (QT) - you may hear that the Fed doesn’t print money, but rather commercial banks print money through lending. Ironically, this idea was far more accurate prior to the QE/QT era.

Historically, the vast majority of money supply expansion occurred by leveraging base money via commercial lending. The Fed sought to influence the pace of credit expansion through interest rate policy, but had little direct control of broad M2.

Credit creation is still a vitally important factor in overall money growth today. However, large scale asset purchases or sales by the central bank (i.e. QE or QT) now allow the Fed to directly influence money supply, to the extent that its counterparties are non-bank entities3 (with primary dealers acting as market-making intermediaries).

A profound impact of QE/QT is the disintermediation of central banks and money supply. Policymakers have more ability than ever to print or shred dollars and are less reliant on coaxing the private sector through interest rate policy.

This is a powerful new tool which policymakers have almost no experience wielding. So far their track record is bleak. The Fed was caught off guard by persistent inflation despite the fact that QE had expanded money supply by 30% in a year - a rate exceeding any modern analog. Now, to combat inflation, the Fed is outright shrinking money supply - an equally anomalous phenomenon.

By overriding traditional money creation mechanics with its new shiny tools, policymakers are insistent on taking the wheel and driving the economy. The result so far has been fishtailing - oversteering and overcorrecting. We have never seen the quantity of “money” change in such a rapid fashion. It’s hard to imagine the result is stability.

Buckle up.

As always, thank you for reading. If you enjoy The Last Bear Standing, tell a friend! And please, let me know your thoughts in the comments - I respond to all of them.

-TLBS

One of the biggest stumbling blocks, when discussing monetary dynamics, is the definition of “money”. For such a critical and seemingly straightforward concept, it is surprisingly hard to pin down. Banknotes - paper cash - are clearly money. But aren’t bank deposits effectively money too, to the extent they can be instantly spent and are federally insured? What about Treasuries? On a corporate balance sheet, a T-bill would be considered a cash equivalent. How about stock holdings? A thousand dollars worth of stock can be quickly translated into $1,000, so that’s kind of money like? What about arcade tokens? Those can be exchanged for ring-pops and plush toys at the counter.

The answer is that there is not one “correct” definition of money. Money is an umbrella concept that can be categorized and measured in a million ways, and no single measurement alone is sufficient. Rather, it makes sense to consider a variety of different measurements in concert, while also keeping a keen understanding of the differences between them.

The distinctions are important. A US Dollar is base money (physical currency and bank reserves) and is “printed” by the Federal Reserve. Meanwhile, money supply is a broader measurement which includes commercial bank deposits and money market funds, and is influenced by the level of base money and the credit expansion of commercial lending.

There is no question that the shift to a restrictive monetary policy stance has been a key driver of the slumping financial markets. However, I would argue that the reduction in liquidity via headline and sub-surface QT have been a greater driver than interest rate hikes (though the two are clearly related). So far, there is no mention of a change of course on QT, which bodes poorly for financial assets, other things equal.

As is the case with a large majority of transactions, when considering the ultimate buyer or seller. As discussed in detail in previous articles, the initial 2008 QE was primarily a recapitalization of the banking sector rather than a stimulus measure. Additional reserves created through QE were offset by more stringent banking regulations on leverage and liquidity. However, the ultimate counterparty of the majority QE/QT are non-bank holders of US Treasuries or mortgage backed securities, therefore directly increasing/decreasing bank deposits and money supply in the process.

There is an aspect that gets lost in the sauce on occasion. The fed risk free rate specifically measures or capitalizes the risk of the US Government as an ongoing enterprise. More broadly, it capitalizes the expectation of risk tomorrow by discounting it to today. The zero interest rates policy held by central banks deliberately skews the capitalization of risk. There cannot be a day where the risk tomorrow (expressed as the e term) is less than the risk today. One is know. The other expectational. The entire enterprise of zero interest rates destroyed savers and bond holders in the economy and forced capital into the equity markets, vastly expanding them, sending indices up and giving the appearance of gains. I hold mixed feelings on the entire enterprise as duplicitous policy.

Thanks again for another great article. Instability is surely in the headwinds.

Your footnote regarding the definition of money reminded me of a great book, one of my favorites on money/finance, titled “The Natural Law of Money” by William Brough 1896. It’s incredibly insightful and evenly technical, like your articles. I believe you would enjoy this read. If you wish to check it out here is a link to a free pdf version: oll.libertyfund.org/title/brough-the-natural-law-of-money

As always, looking forward to next week’s piece. Have a good week.