For the past week, the White House has rag-dolled the global financial market with its ever-changing whims. The level of volatility is historic, sharing company with the worst market crises of the past century.

And yet this episode is in a category of its own. Whether it’s freewheeling chaos, elaborate negotiation tactics, or a stiff cocktail of the two, there is a level of reality TV drama that suits the parties involved. And for all the round-tripping of this week, the S&P 500 is up a relatively mundane 3.3% on the week, through Thursday’s close.

Considering the titanic trade shifts in question, some bigly swings are justified. But in some way, the drama seems to be crowding out more acute analysis.

The market is stuck in an overly simplistic binary, where “more tariffs = bad”, “less tariffs = good”. As equity correlation has surged to multi-year highs, the vast majority of the market has traded in tandem with the changing tune of the administration. As a knee jerk reaction, this impulse is correct — if a global trade war triggers a recession, it’s bad news for everyone.

But investors should quickly sharpen their pencils. There has been relatively little distinction or discrimination in how these current tariffs will impact individual companies. In some cases, perhaps too much pain is being priced; in others, not enough.

Wednesdays’ historic turnaround is a perfect example. At 1:19pm the White House announced a 90-day pause on reciprocal tariffs for every country except China, while upping the China tariff rate to 145%1. The result was one the largest one-day rallies in market history — a near universal green screen with advancing stocks outnumbering declining stocks at a rate of ten-to-one.

But other than the massively oversold positioning and desperate desire for relief, did that market action make any sense?

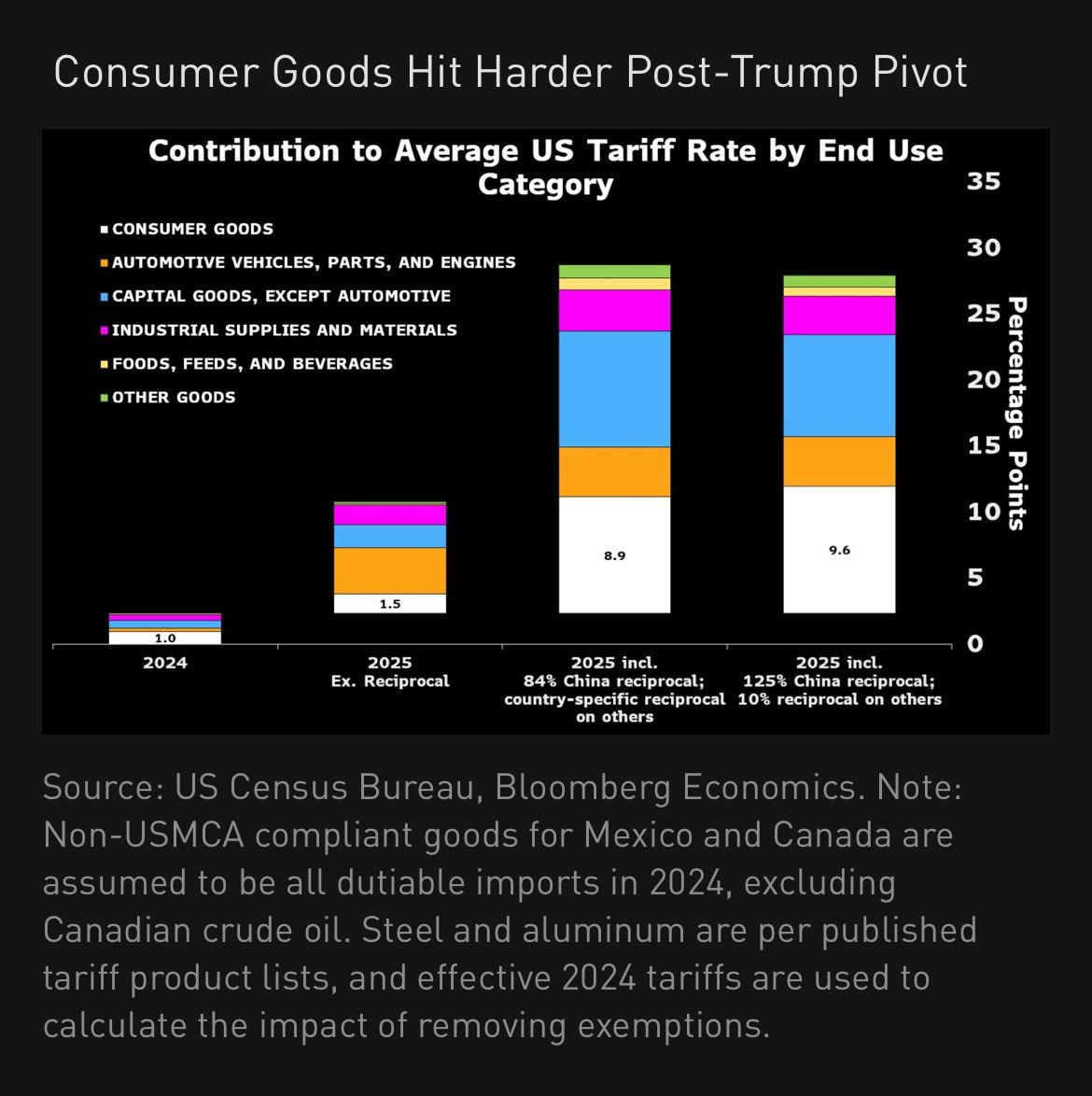

Sure, the perception of flexibility and de-escalation was taken as a positive. But as Bloomberg’s Anna Wong calculated later in the evening, the impact of increased China tariffs cancelled out the impact of lower reciprocal tariffs elsewhere, leaving the total tariff stack more or less unchanged on an aggregate basis.

But for any single company reliant on foreign goods, the news was either very good or very bad depending on its relative exposure to China.

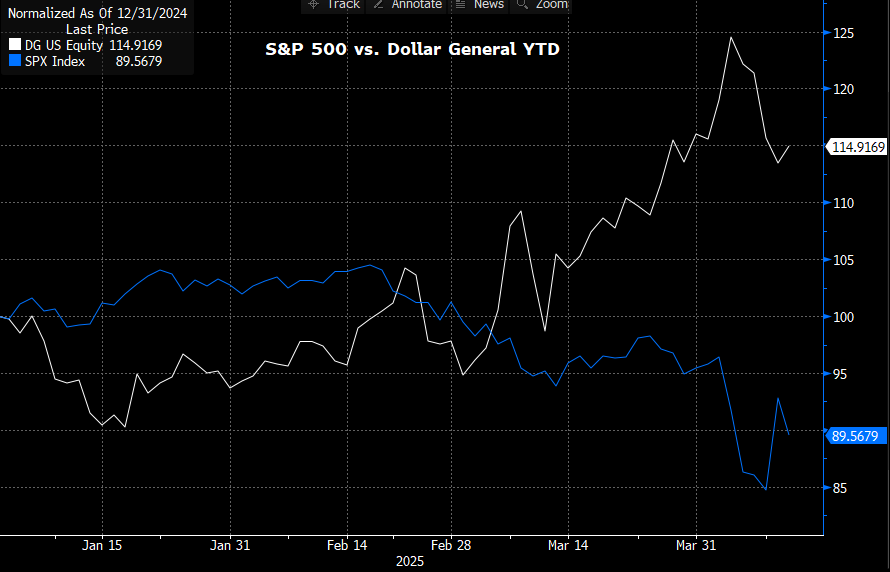

As a high-profile example, why did Apple — which sources a large majority of its hardware from China — rally 15% on the day that its tariff rate increased dramatically2? Elsewhere, why are certain dollar stores — which source nearly all of their merchandise from China — still providing a “recession” safe haven?

Moving forward, more critical judgement is set to drive relative performance. Here are twelve stocks that stand on the firing line.