For months, we’ve been circling the drain — the median stock peaked back in December, DOGE took office in January, Tariff-talk arrived in February, soft data started screaming in March. Now, it’s April and we’ve passed the point of no return. We’ve entered The Vortex.

Markets are only beginning to price this reality.

I’ve written about the turning cycle — untethered euphoria, the turn of sentiment, the moment of AI disbelief, and “max stupid” ringing the bell. So far, we’ve played it tactically, focusing on the lowest hanging fruit by top-ticking nuclear nonsense, and shorting pre-revenue memes.

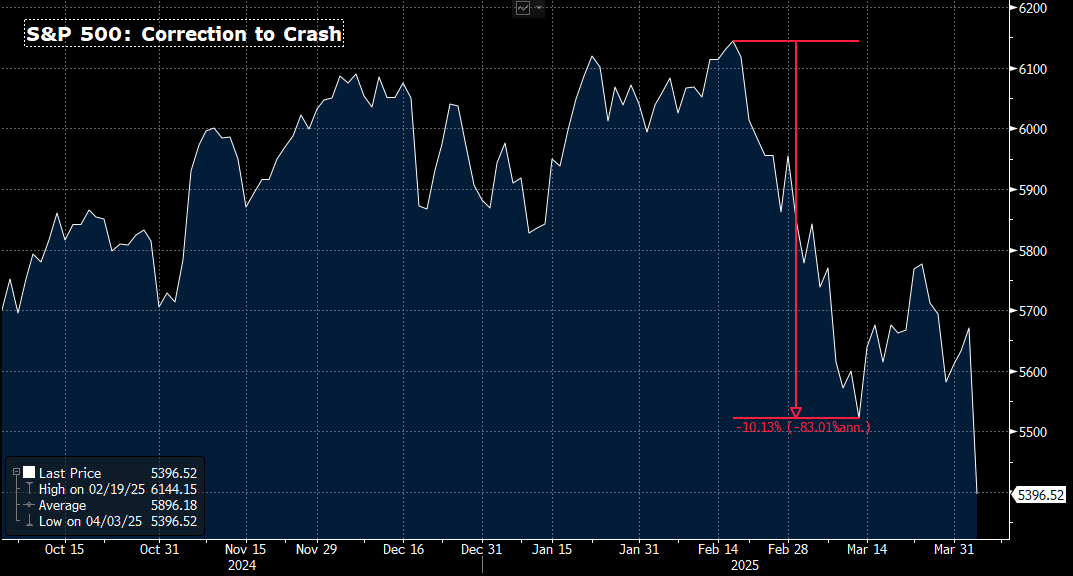

Fading momentum alone was enough for a market correction, and the S&P 500 did indeed notch a 10% drawdown by early March. Unsurprisingly, dip buyers held the index in limbo for the past three weeks while traders did their best to explain away the flashing warning signs while calling political bluffs.

But this week’s events change the landscape dramatically. Not only is hard data beginning to confirm a material consumer slowdown, but the hopes of Trade War skeptics were violently squashed in the White House Rose Garden.

What lies ahead is much more daunting than a mean-reversion. Trump’s tariffs represent the most extreme and sudden reversal of US trade policy maybe in the nation’s history. Do not underestimate the significance.

It’s not a negotiation tactic to reduce trade barriers, it’s a retreat from free trade for the purpose of national security and realignment. It’s not a policy to juice economic metrics, it’s one that will bring immediate pain. It’s not a stick or a carrot, its a wrecking ball, intended to dismantle the status quo — a status quo that has supported market gains for decades.

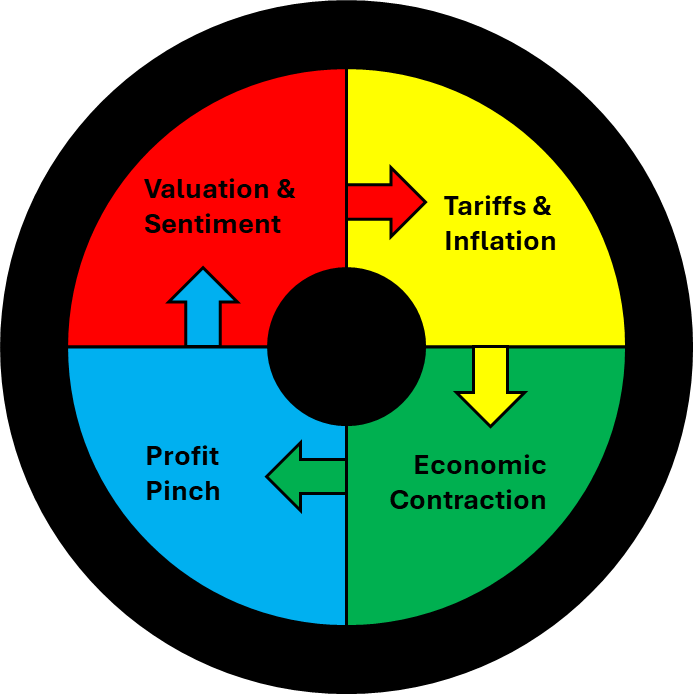

The implications are profound and come at a precarious moment. For the past several years, the US economy has been powered by stimulus, fiscal spending, and the wealth effect, leading to complacency and vulnerability. Now, we are seeing slashed spending, government firings, and tax hikes in the form of aggressive tariffs, while the single largest store of paper value crumbles. At the same time, consumer spending is fading and real GDP may already be in contraction.

These factors are reinforcing and accelerating. The Trade War has only just begun — retaliatory measures have yet to be announced and few parts of the global economy will remain untouched. Supply chain disruption, policy-based inflation, and business uncertainty will put even greater downward pressure on economic activity. Against the backdrop of rising import taxes and a weak consumer, corporate profits will come under pressure. Declining earnings will hasten the deflation of market multiples as any last bit of optimism dies.

What we now face is different from the last several market downturns.

In 2020, an exogenous shock was counteracted by extreme monetary and fiscal support, while global actors largely put aside their differences for the greater good. In 2022, demand-driven inflation forced rate hikes, but the underlying US economy was still in a strong rebound, and the war in Europe had minimal impact stateside.

Today, we contemplate something different; a market crash, rising global tensions, supply-side inflation, and even a severe global recession.