Is ignorance bliss? Or is ignorance risk?

Of all the developments that have come out of the failure of Silicon Valley Bank (SVB), I’ve been spending time thinking about disclosure, transparency, and risk.

One strength of the U.S. financial system is its high degree of transparency. To go public, a company must navigate a rigorous application and approval process with the Securities and Exchange Commission (SEC). After an IPO, the company must report extensive 10-Q quarterly and 10-K annual filings covering all aspects of the firm’s financial accounts and operations. If a “material” development occurs in the interim, the company must publish an 8-K filing alerting the market. Similarly stringent regulations govern other segments of the U.S. financial system.

The level of transparency has been a stumbling block for international companies looking to access the enormous U.S. financial market. From Middle Eastern oil companies to mainland Chinese companies, many simply refuse to open (and audit) the books in the way that U.S. regulations demand.

As investors, we view these regulations as beneficial. We want access to information - good and bad - to help guide investment decisions. But the SVB failure shows that disclosure and transparency can be ironically double-edged, particularly in a reflexive system with substantial illiquid value and limited liquidity.

If we choose to see no evil does evil not exist?

In certain circumstances maybe ignorance is a feature, not a bug, to the extent that it helps maintain stability. In the past month, we have seen competing systems play out with somewhat surprising results.

The Tether Revival

Back in November, we analyzed the largest stablecoins (Tether, USDC, and BUSD) in Inside the Vault. While Tether’s disclosures remained woefully inadequate, we were encouraged by the growing market share, disclosure and compliance of USDC.

To wit:

USDC is widely considered the highest quality stablecoin. It is a licensed US Money Transmitter; it holds its assets with large US financial institutions. Grant Thornton (a reputable U.S. auditor) provides monthly assurances out of its New York office, which include specific CUSIPs of its Treasury holdings. Its assets as of the end of September included $38 billion of Treasury Bills and $9 billion of cash in the bank…. [USDC provides] a template for how a regulated, well-functioning crypto market could operate in tandem with the traditional financial market.

But of course, neither Treasury holdings nor bank deposits are actually dollars. And it just so happened that $3.3 billion, or roughly 8% of USDC’s backing, were deposits at SVB.

As SVB failed on March 10th, USDC dutifully released a press release announcing its exposure, and the possible path for recovery. The reaction was an immediate, dramatic de-pegging of the stablecoin. USDC’s trading price hit a low of $0.90 in the early morning hours of Saturday March 11th, as holders briefly wrote-off all of USDC’s deposits at SVB (and then some).

Of course just a day later, all SVB depositors including USDC were backstopped by regulators under the “systemic risk exception” determined by the Federal Reserve, U.S. Treasury, and FDIC. By Monday morning, USDC had regained its peg of $1.00. Yet, even as the bailout re-pegged USDC within a weekend, outflows have only continued. Since March 10th, USDC’s circulation has cratered by 23%, with over $10 billion heading for the exits.

The beneficiary? Tether.

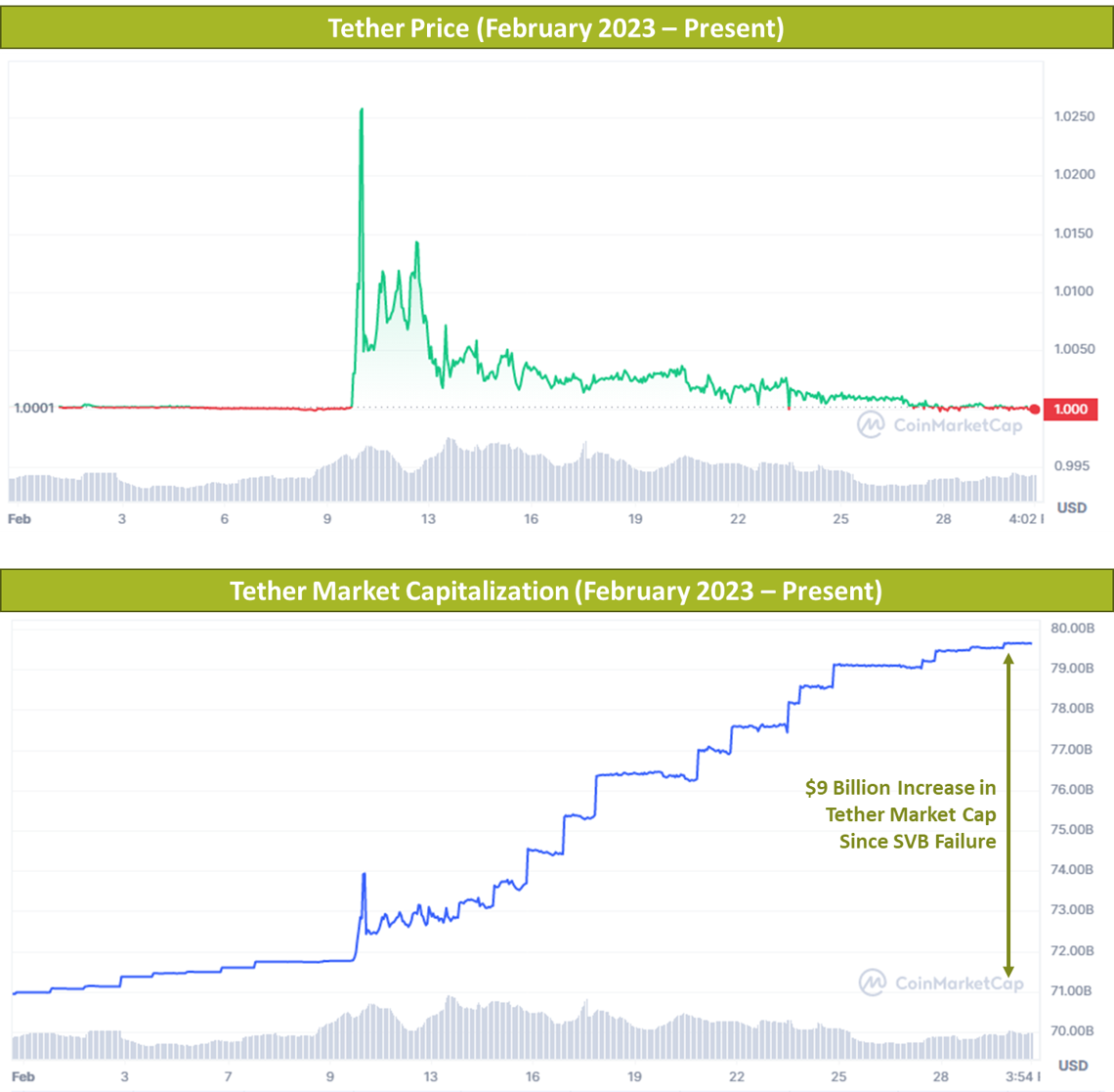

Tether saw an initial surge in price as money fled USDC on the SVB announcement. In the intervening weeks, Tether seems to have captured nearly all of the flows from USDC, adding $9 billion to its circulation.

While the initial scramble from USDC to Tether is understandable, it is more interesting that these flows continued long after USDC’s asset uncertainty was resolved with no losses. It marks a stark reversal of the Tether’s shrinking market share since mid-2021 into “higher quality” stablecoin issuers.

Tether has a history of being drastically undercollateralized, has stubbornly rejected calls for transparency, is invested in opaque high-risk assets, and still can’t produce a high quality audit - and yet it is regaining its position as a safe haven, ironically spurred by the transparency of its competitor1.

On the surface, this may seem irrational. After all, if Tether had $3.3 billion of bank deposits at risk, it certainly wouldn’t issue a press release warning investors. We wouldn’t know about it, which is exactly the point. Ironically, Tether’s greatest weakness - uncertainty around its backing and business practices - is also a deliberate strength. Tether may be swimming naked, but in muddy waters, no one knows for sure.

Further, with its ability decide when to honor withdrawals, Tether has “tools” to stop a bank-run via brute force. How long could an insolvent money market fund remain liquid if no one knew it was insolvent and it could choose to gate withdrawal requests? Probably a really long time.

For the time being, stablecoin investors have decided that when it comes to Tether, they see no evil. Ignorance is bliss.

The Bank Crisis (and the one that wasn’t)

Back in 2021, China’s de-leveraging campaign toppled its first giant, Evergrande. Once the largest property developer in the country, Evergrande failed with over $300 billion of balance-sheet liabilities (greater than the total assets of SVB) and much more hidden off the books.

After correctly predicting the rout in Chinese developer’s USD bonds and a collapse in the real estate market, we looked to risk in the Chinese banking sector. In a series of Twitter threads, we laid out the risks to rural and regional Chinese banks.

To wit:

If contagion in the property sector spreads… a Chinese banking crisis is a significant risk… PBOC liquidity injections only go to the large banks who must choose to lend on to smaller banks, where the greatest concerns lie. The closest scare happened in 2013, when interbank lending froze - there was adequate bank liquidity in aggregate, but it was hoarded by larger banks, not provided to the smaller banks who needed it... This does not mean that *all* banks will fail. But even the failure of one, and the fear of contagion, is enough to substantially disrupt markets globally.

Sound familiar? If you replaced “Chinese” with “American” and “property” with “bond losses”, you would have a decent explanation of the failure of SVB and its ramification on bank stocks globally.

Yet, despite the demise of property developers and a year-long depression in the Chinese property sector, there hasn’t yet been a banking crisis in China. It’s not that there hasn’t been stress - rather struggling Chinese banks have used a variety of methods to stay afloat ranging from police intervention to suppress protests, to manipulating the COVID health code system to prevent access to bank branches, to simply freezing funds.

All the while, there has never been a true acknowledgement of non-performing loans and the insolvent position of many of these rural banks. Instead, it appears that there was a large, unpublicized, centrally coordinated cash infusion in the form of Certificates of Deposits (CDs) to at-risk banks at some point in 20222. Little information can be found to explain this sudden surge in liquidity - that is the point.

These alternatives aren’t available to U.S. banks. If SVB could have told its depositors “no” as they demanded billions in cash3 on March 9th, then SVB would not have failed on March 10th. Further, if SVB was not forced to publicize its fundraising efforts or its eroded capital position, then there would not have been a bank run in the first place. Instead, when a U.S. bank is deemed insolvent or can’t meet withdrawals, it is taken over by regulators.

As both Chinese and U.S. banks have come under stress, the difference in system and approach is obvious. In China, the loses are not openly addressed or publicized. Cries of angry depositors are suppressed while a central response is formulated behind the scenes. Chinese regulators make sure to see no evil (at least in public).

By contrast, the U.S. adheres to its notion of transparency and depositor rights, which ironically can help foment a bank run and contagion in the process. Central bailouts were required in both instances - one in private and one in public.

Conclusions

So, is ignorance bliss, or is ignorance risk? Maybe a bit of both, and maybe it depends on the time frame. As the examples above demonstrate, it is easy to overestimate the “risk” of the opacity, without acknowledging the near-term benefit it can provide in certain circumstances.

Shining a bright light into dark corners reveals the skeletons in the closet4. It ensures that decaying remains are identified and removed. But finding skeletons in the closet is scary - and when an illiquid investment pool relies on people keeping their cool, discovering skeletons can be dangerous.

In the short term, it seems expedient to ignore the stench. Over a longer term though, it’s hard to see how an opaque system will lead to efficient and productive growth.

In the case of Tether, investors are relying on the relative “flexibility” of the firm to manage public confidence and its cash flow by gating withdrawals. Yet, investors take substantial long-term risk in this process by allowing the company this leeway. The risk is that if and when skeletons are uncovered, the losses will be much greater.

In the case of banks, it is good when a bad bank fails to the extent that it discourages bad management. Immediate intervention by regulators ensures that depositor recoveries are maximized and distributed fairly. Depositors can’t be frozen out of their accounts without recourse. By contrast, backdoor dealings to save bad banks merely reinforces the status quo.

Yet, as we have seen, even the failure of a bad bank can create a spiraling effect of contagion and panic that can spread beyond bad actors. For regulators and public officials, this comes with embarrassment and loss of faith.

Perhaps the lesson is that risk exists, whether hidden or disclosed. Whether you choose to see it is up to you.

If you enjoy The Last Bear Standing, please subscribe, hit “like”, and tell a friend! Let me know your thoughts in the comments - I respond to all of them.

As always, thank you for reading.

-TLBS

It’s possible that moves from USDC to Tether could also involve perception of regulatory risk - as holders see increasing U.S. enforcement action, perhaps they are looking to move money further away from the hands of U.S. regulators. But the timing strongly suggests that the SVB failure and USDC de-pegging was the driving factor.

This playbook isn’t new. In the past, CDs have been used to inject liquidity to struggling banks and relieve interbank funding stress in China.

Or, borrowed from the crypto playbook and closed its online access for “scheduled maintenance”.

Perhaps the best argument for transparency is that it puts the onus on investors to manage risk. Don’t come crying for a handout because you failed to do your diligence. However, the notion of a “bailout” has somehow transformed from a dirty word to business as usual. This removes the need for diligence in the first place.

Isn't the relative outperformance of USDT also a function of growing US regulatory risk? After all, it appears there's a reasonable chance that the FDIC seized SBNY because of crypto activity, not solvency.

A transparent financial system, with well-regulated & liquid markets -- if we can keep it!

Many have said it...another context is Post 80's to current day its been the "Socialization of Risk" both government and private sector with political actors picking there own tribal-winners with the pendulum never stopping or balancing out and given the intricacies of technology memes like A.I., this dynamic of socializing risk will only continually rise in scale/methodology. Universal Health Care, Social Security, UBI, Job Guarantee, Subsidies, Trade Wars, Taxes, Bank/Depositor Rescue, Global CB's..its all the same dynamic....no belief or argument here, just an observation!