From buying dips to selling rips, the breakdown in U.S. equities continues. After two red weeks, a position that has taught traders to reflexively anticipate a rally, stocks have failed to find footing. Bears have awoken, and they are hungry.

There has been plenty of negative news to devour.

Trump’s tariffs announced on Sunday soured the mood from the start, and the subsequent reversals have failed to rebuild confidence. Beyond the direct effect of trade policy, the daily flip-flops look less like 3D chess and more like a flailing ad-lib. On Wednesday, ADP reported the weakest payroll gains in seven months, missing estimates by a mile. The Challenger report recorded the largest monthly in job cuts since COVID as DOGE clearcuts the Federal workforce. The Atlanta Fed’s1Q25 GDP nowcasts stands at negative 2.4%, even if driven by import oddities like transatlantic gold shipments and tariff front-running.

The turnaround in sentiment has been stark. Just months ago, Trump’s election sent the market and meme-stocks soaring. Now the growing consensus, even parroted by his advisors, is that the President’s intent is to break the market’s back.

Last week, I argued that this dip is different, and from a technical standpoint it is. While the drawdown alone is not extraordinary, it comes on the back of several stalled rallies and now threatens to break the trendlines that haven’t been tested in years. Chartists watch anxiously as the S&P 500 closed yesterday on its 200-day moving average, threatening to break the long-term momentum indicator for the first time in eighteen months.

Yesterday, the Nasdaq 100 broke this line in the sand for the first time in two years.

Regardless of whether these levels provide support in the near-term, something bigger is afoot.

We’ve looked at this market with growing incredulity for months, and fading the more outlandish narratives has proven wise. The Nuclear Narrative top-ticked the power trade with Constellation (CEG) and Vistra (VST) in a 40% meltdown since the publication in late January.

Meanwhile, the near universal collapse of the meme-cos continues. From a wide menu of candidates, the Four Shorts highlighted two weeks have cratered 25% - 40%.

But this growing negative outlook isn’t based on short-term price action, recent headlines or the volatility in the absurdities. Rather, qualitative and quantitative factors visible for months suggest a new regime is forming.

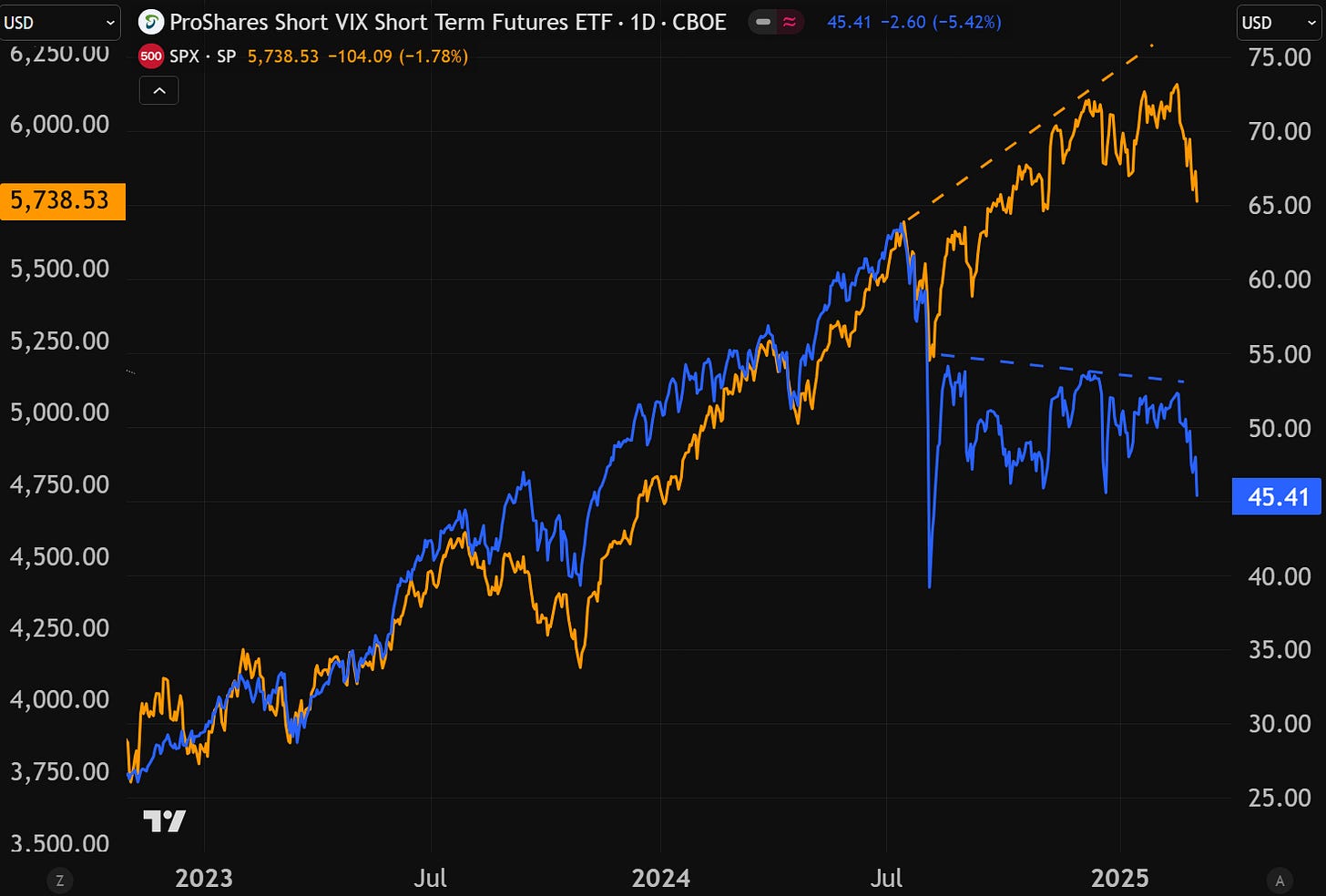

The volatility unwind that began last July was a notable turning point and early warning sign. Up until that point, the rally was supported by consistently declining implied volatility, bringing liquidity to the market and indicating investor’s growing comfort with insuring risk. But the subsequent bounce in equities has come with rising volatility, a shaky foundation.

With multiple expansion driving the lion’s share of appreciation, and valuations stretching to extremes, the market has become as vulnerable to swings in sentiment even absent an underlying downturn. And with surging call options providing much of the juice for gains, a mere retreat in enthusiasm can trigger a correction.

As more supportable theses like the AI buildout began to waver and were supplanted by speculation throughout the winter, it seemed the hype cycle was reaching a predictable peak. Deepseek’s Moment of Disbelief showed that investors were willing to throw in the towel on its most core convictions of the past two years. The Max Stupid blow-off top, with its some striking similarities to last cycle’s apex, provides further confidence.

Now, the more recent awakening of geopolitical realignment, trade and tariffs, and policy upheaval provide more concrete fuel to drive the downturn.