Ring the bell, the party’s over.

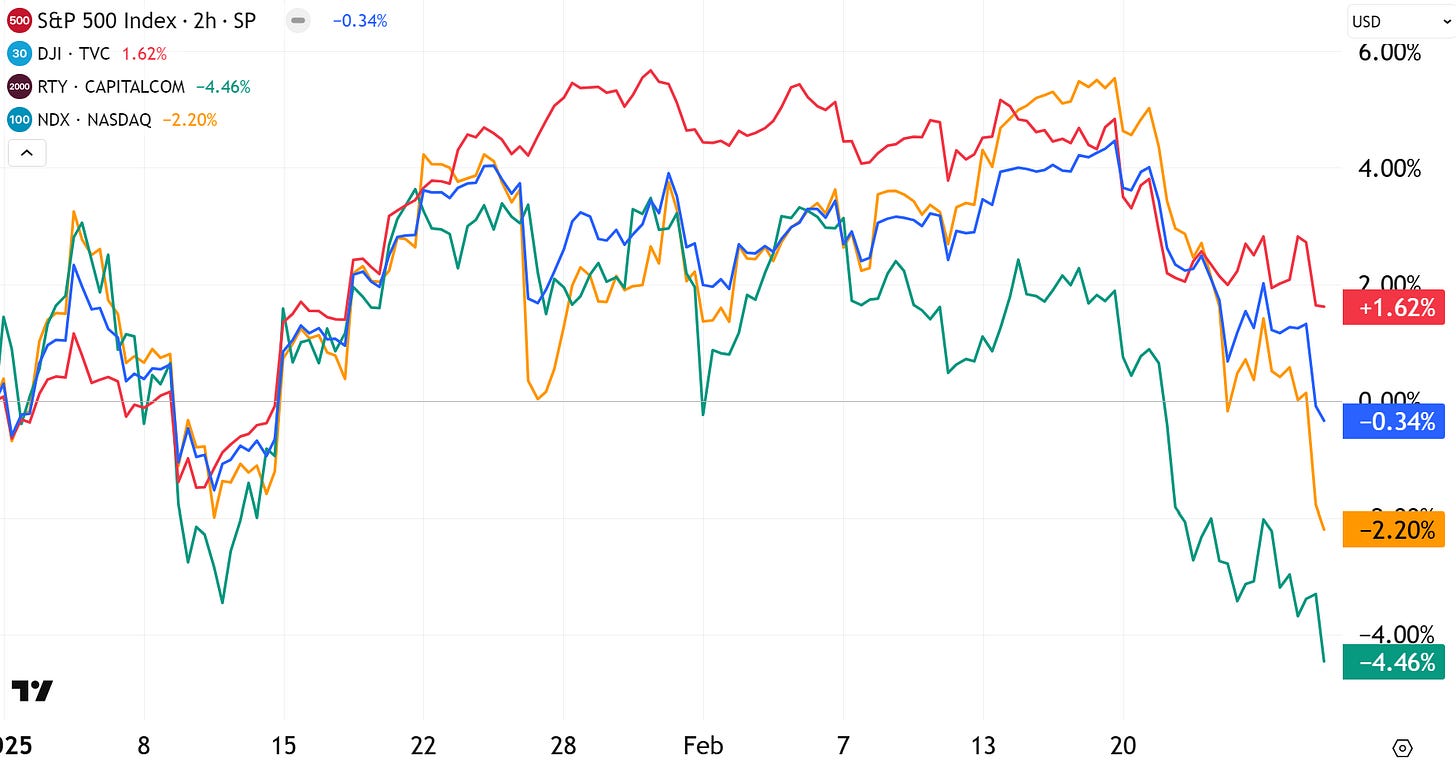

On the surface, this latest market swoon is nothing special. Since briefly kissing new all-time highs last Wednesday, the S&P 500 has fallen 5%. But the benchmark still trades within the range of recent chop and remains flat on the year. The defensive Dow Jones has held firmer, while the Nasdaq 100 and Russell 2000 have underperformed.

But under the surface, there has been a neck snapping whiplash in sentiment. Just two weeks ago, momentum junkies chased 10% daily jumps in names like Palantir (PLTR), Robinhood (HOOD), Hims & Hers (HIMS), and Applovin (APP)— stocks that are now yacking up their blow-off tops in the past several sessions.

Meanwhile, Bitcoin is swimming with cement boots, working on completing a mirror image reversal of its post-election breakout.

But this bloodbath didn’t come out of nowhere — there have been warning signs if you’ve been paying attention. Discussed last week in Four Shorts, signs of a momentum breakdown in speculative shares finally set up actionable opportunities on the downside.

Since publishing the short recommendations last Friday, each of these pure-blood meme-cos have fallen between 21% - 30% as of Thursday’s close. (RKLB and ACHR are each down another ~15% in today’s pre-market trading).

Even the AI infrastructure trade — the bulwark of this bull market — seems exhausted. NVIDIA’s earnings beat on Wednesday evening was rewarded with a 8.5% plunge on Thursday, as the stock trades back to its DeepSeek lows. When good news is punished, it’s a telltale sign that expectations have run ahead of reality1.

Still wounded from China’s AI breakthrough, swirling reports of Microsoft’s cancelled datacenter capacity and some sober reflection on AI demand from CEO Satya Nadella in media appearances last week have helped shift the narrative from endless enthusiasm to the overbuild2. As I argued in A Moment of Disbelief, souring sentiment in AI, rather than actual the underlying stories, may be a more important signal for where this market is heading — for what it’s willing to believe.

But haven’t we seen these drawdowns before? Momentum was mushed last April, and the summer unwind in late July brought a far more extreme spike in volatility. Am I cherry-picking a couple of bad apples?

At moments like these, I think it’s best to be as direct as possible. This dip is different.