For the past several months, this column has shone a spotlight on growing speculation in the market. We might squabble about index valuation, the economic cycle, or macro trends, but there is little doubt that some micro-bubbles have formed beneath the surface. Specifically, we’ve been tracking “new-era” sectors with several traits.

Negligible revenues, major losses

Grand narratives based on unproven technology

Massive price appreciation over the past four months

These stocks have traded higher in-step not because of any fundamental connection, but a stronger unifying force. They each surf on the same wave of speculation — momentum-based trend chasing fueled with options leverage. It’s a wave that we saw building in the early fall and cresting in the post-election euphoria. Some of these companies may have bright long-term futures, but their current trading is more related to Fartcoin than the S&P 500.

I’ve documented the inflation of these bubbles and provided level-headed analyses of the underlying industries, but stopped short of recommending readers fade the hype. Standing in front of a crazy train is a bad idea, so long as it remains on the rails.

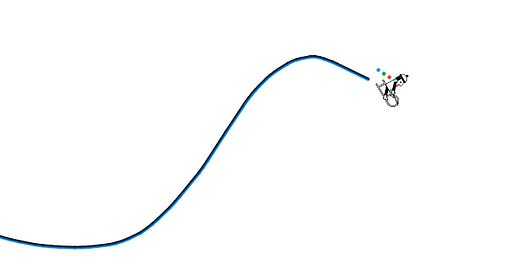

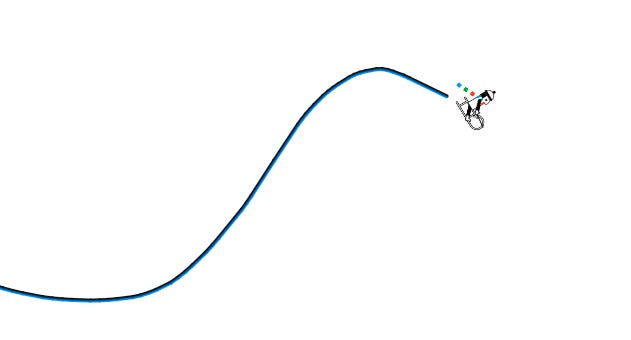

But it seems the tide is finally turning. Over the past several weeks, these shares have shown classic churning and hesitation — a rocket that has exhausted its fuel, suspended for a moment as thrust gives way to gravity. Now, the charts are breaking down, and a downside reversal is the most likely next step.

In other words, these are now actionable short opportunities.